The Ultimate Guide To Hsmb Advisory Llc

The Ultimate Guide To Hsmb Advisory Llc

Blog Article

The 15-Second Trick For Hsmb Advisory Llc

Table of ContentsThe Ultimate Guide To Hsmb Advisory Llc3 Simple Techniques For Hsmb Advisory LlcThe 6-Minute Rule for Hsmb Advisory LlcThe Greatest Guide To Hsmb Advisory Llc

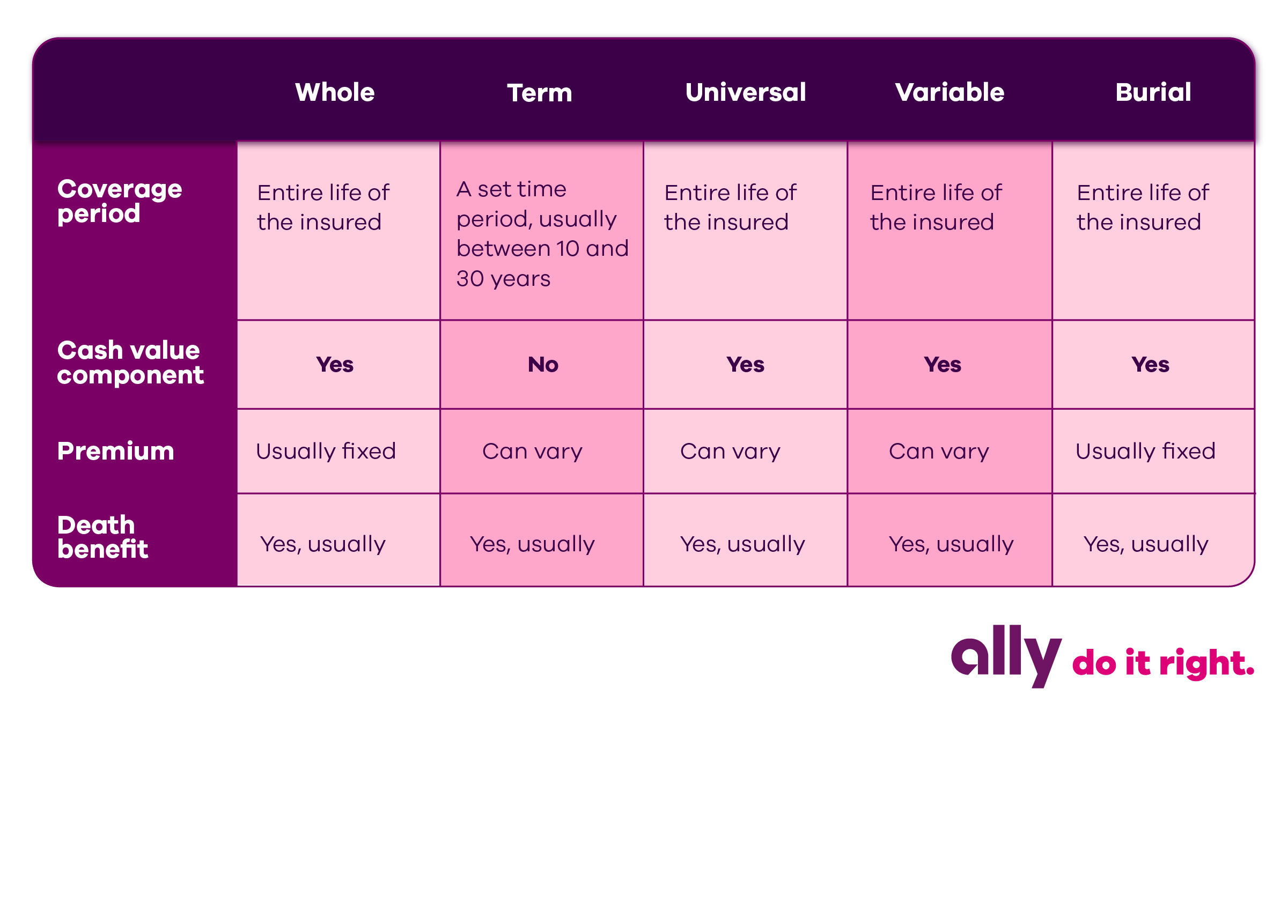

Life insurance policy is especially vital if your family is reliant on your income. Sector experts suggest a plan that pays 10 times your yearly earnings. When estimating the quantity of life insurance policy you require, aspect in funeral service expenditures. Calculate your family members's day-to-day living costs. These may include mortgage payments, exceptional loans, bank card financial obligation, taxes, day care, and future university prices.Bureau of Labor Stats, both partners functioned and brought in income in 48. They would certainly be most likely to experience monetary hardship as an outcome of one of their wage income earners' deaths., or private insurance coverage you purchase for on your own and your family members by getting in touch with health and wellness insurance business directly or going via a health insurance policy agent.

2% of the American population lacked insurance policy protection in 2021, the Centers for Illness Control (CDC) reported in its National Center for Wellness Statistics. Even more than 60% got their insurance coverage via a company or in the personal insurance policy marketplace while the rest were covered by government-subsidized programs consisting of Medicare and Medicaid, experts' benefits programs, and the government industry developed under the Affordable Care Act.

Hsmb Advisory Llc Can Be Fun For Anyone

If your revenue is reduced, you may be among the 80 million Americans who are qualified for Medicaid. If your earnings is moderate however doesn't extend to insurance policy protection, you might be qualified for subsidized insurance coverage under the government Affordable Treatment Act. The ideal and least expensive choice for salaried employees is usually taking part in your employer's insurance program if your employer has one.

Investopedia/ Jake Shi Long-term disability insurance policy sustains those who end up being unable to function. According to the Social Safety and security Administration, one in 4 employees going into the workforce will certainly become impaired prior to they reach the age of retirement. While wellness insurance policy spends for hospitalization and medical bills, you are usually strained with every one of the expenditures that your paycheck had covered.

Several policies pay 40% to 70% of your income. The expense of disability insurance is based on many elements, including age, way of living, and health and wellness.

Numerous strategies call for a three-month waiting period before the coverage kicks in, offer an optimum of 3 years' well worth of coverage, and have considerable policy exemptions. Below are your alternatives when purchasing cars and truck insurance: Liability protection: Pays for property damage and injuries you create to others if you're at fault for a mishap and additionally covers lawsuits prices and judgments or settlements if you're taken legal action against due to the fact that of an automobile mishap.

Comprehensive insurance covers theft and damage to your automobile because of floodings, hail storm, fire, criminal damage, dropping things, and pet strikes. When you fund your auto or rent an automobile, this kind of insurance is mandatory. Uninsured/underinsured motorist () insurance coverage: If a without insurance or underinsured driver strikes your automobile, this protection pays for you and your passenger's medical costs and might additionally make up lost earnings or compensate for pain and suffering.

Employer protection is often the finest alternative, yet if that is not available, acquire quotes from a number of carriers as many offer price cuts if you acquire greater than one type of coverage. (https://www.taringa.net/hsmbadvisory/health-insurance-st-petersburg-fl-your-ultimate-guide_5bpkou)

The 5-Second Trick For Hsmb Advisory Llc

In between health and wellness insurance coverage, life insurance policy, disability, liability, long-term, and also laptop insurance policy, the job of covering yourselfand assuming concerning the endless possibilities of what can take place in lifecan really feel overwhelming. As soon as you recognize the principles and make certain you're adequately covered, insurance coverage can enhance financial confidence and well-being. Here are one of the most essential sorts of insurance you need and what they do, plus a pair suggestions to prevent overinsuring.

Different states have various policies, however you can anticipate medical insurance (which many individuals survive their employer), car insurance (if you have or drive a lorry), and house owners insurance (if you have residential or commercial property) to be on the listing (https://forums.hostsearch.com/member.php?256834-hsmbadvisory). Required types of insurance coverage can change, so check out the most recent laws from click reference time to time, especially before you renew your policies

Report this page